The Bitcoin market has been calm for the higher a part of Might, as costs hover in a comparatively steady vary between $26,000 and $28,000.

Nonetheless, beneath this seemingly tranquil floor, a number of on-chain metrics point out potential shifts in market sentiment and investor habits.

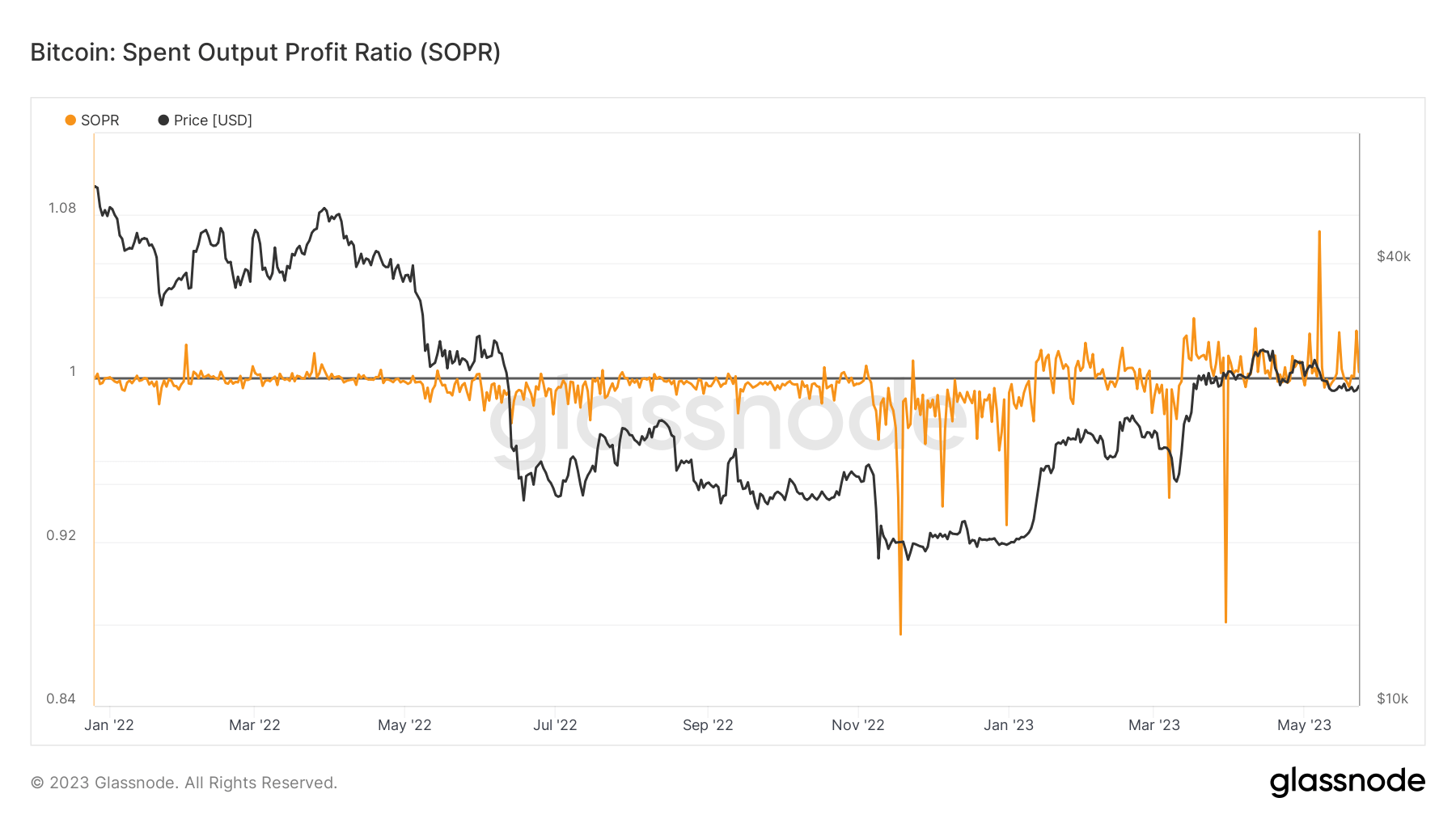

The Spent Output Revenue Ratio (SOPR) is a precious gauge of profitability and losses that the market has incurred. SOPR worth better than 1 means that, on common, the cash moved on-chain throughout that interval are being offered at a revenue. Conversely, a SOPR worth lower than 1 implies that cash are, on common, being offered at a loss.

SOPR is trending decrease and is progressively approaching the vital threshold of 1. Whereas this will likely seem to be a trigger for concern, you will need to be aware that declining SOPR values may additionally point out a market section the place buyers are holding their property, anticipating favorable market situations or larger costs sooner or later.

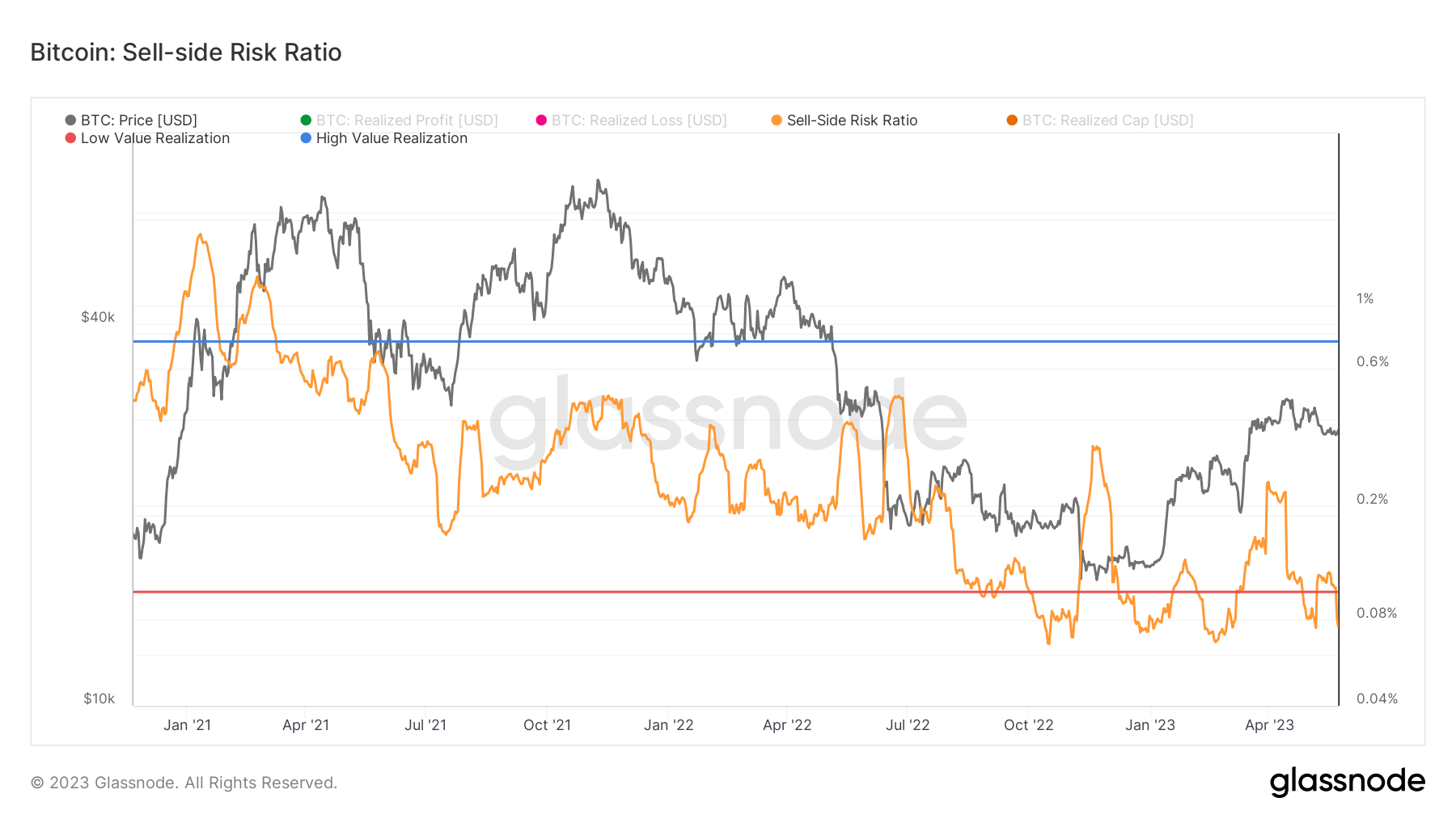

The Promote-side Danger Ratio offers precious insights into the general sell-side strain available in the market, evaluating the overall USD worth spent by buyers on-chain to the overall realized market capitalization. When the ratio is low, it signifies that the mixture sell-side danger available in the market is comparatively minimal. This means a interval of low-value realization and decreased market volatility, which is commonly related to market consolidation and sideways developments.

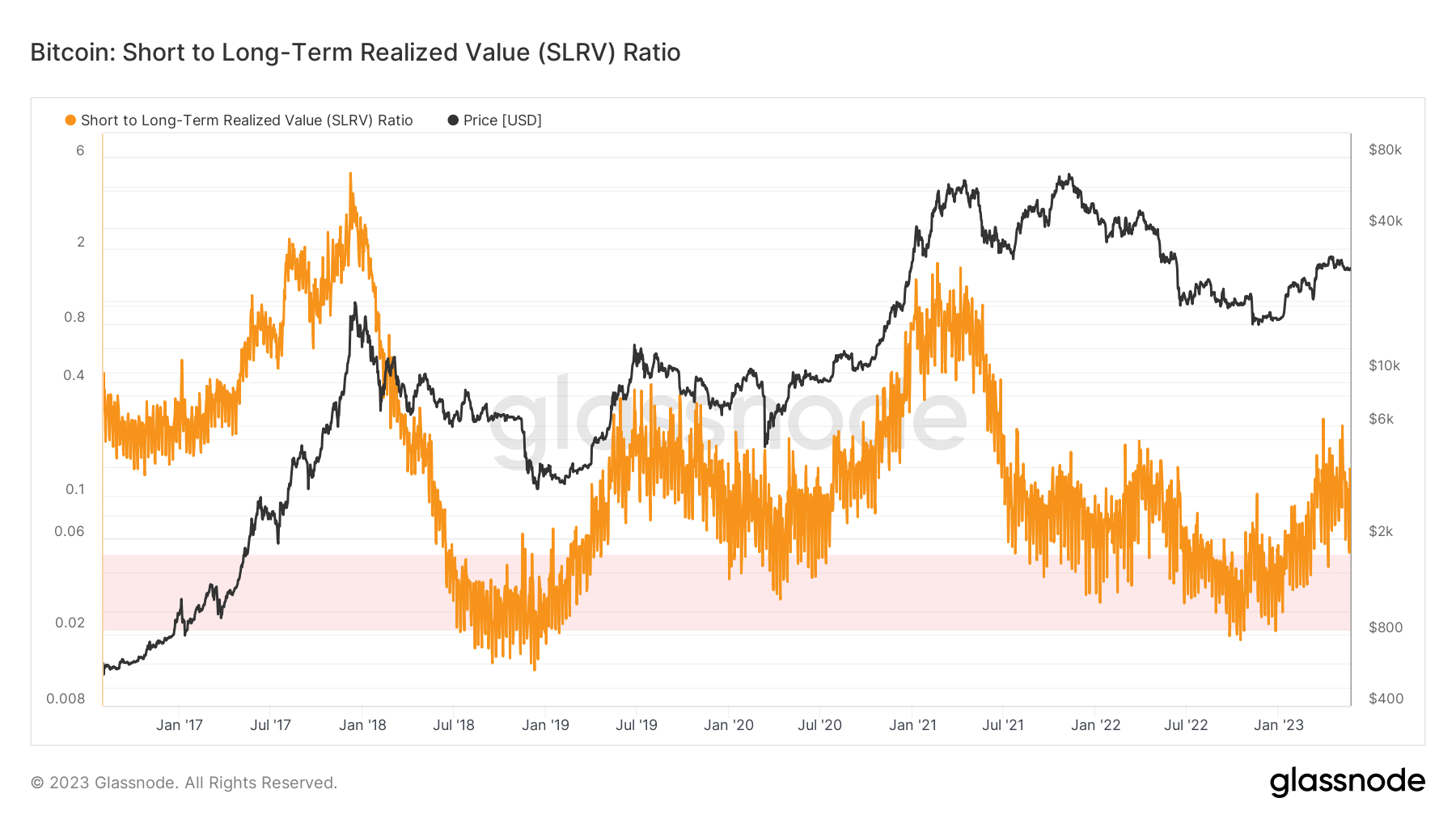

The Brief-to-Lengthy-Time period Realized Worth Ratio assesses short-term transactional exercise versus long-term holding. A low SLRV ratio suggests restricted short-term exercise and curiosity in Bitcoin or the emergence of a rising base of long-term holders. This may point out an accumulation section and a comparatively low sell-side danger atmosphere.

A CryptoSlate evaluation earlier immediately discovered that whales holding over 10,000 BTC gathered for the higher a part of April and have entered one other accumulation spree.

Because the starting of Might, the SLRV Ratio has been exhibiting a downward pattern. That is in keeping with earlier findings and additional confirms the broader market pattern of low sell-side danger, creating fertile floor for accumulation.

The present state of the Bitcoin market presents an uneventful facade, however a deeper evaluation of on-chain metrics reveals refined nuances that might form its future worth actions. The declining SOPR, low Promote-side Danger Ratio, and SLRV ratio point out a market atmosphere characterised by decreased volatility, consolidation, and a possible accumulation section.

The submit Regardless of latest stillness, on-chain metrics point out potential volatility forward for Bitcoin appeared first on CryptoSlate.