RGB and Taro, two protocols able to placing tokens like stablecoins on Bitcoin, have taken totally different approaches to fixing related issues.

That is an opinion editorial by Kishin Kato, the founding father of Trustless Providers Ok.Ok., a Japanese Lightning Community analysis and growth firm.

Demand for stablecoins on Bitcoin is returning because the Lightning Community presents large scalability benefits. At the moment, customers in rising markets who need to transact and save in USD will accept stablecoins on different chains, in accordance with proponents. Placing my private emotions about these different blockchains apart, I have to acknowledge that bitcoin obtained in low cost, cross-border remittances can not simply be bought for {dollars} whereas they reside in non-custodial Lightning channels.

RGB and Taro are two new protocols that allow token issuance on Bitcoin, and are subsequently anticipated to carry stablecoin transactions on Lightning. I studied these protocols and the client-side validation paradigm that they make use of and revealed a report on my findings known as “Emergence Of Token Layers On Bitcoin” via Diamond Palms, a significant Japanese Lightning Community consumer and developer neighborhood and Bitcoin-focused answer supplier.

Throughout this analysis, I observed refined variations in how these seemingly-similar protocols had been being developed, and have become excited about how these variations could have an effect on their trajectories. On this article, I wish to share my impressions of those initiatives and the way they might have an effect on Lightning as we all know it.

Priorities And Mindset, Revealed By means of Protocol Growth

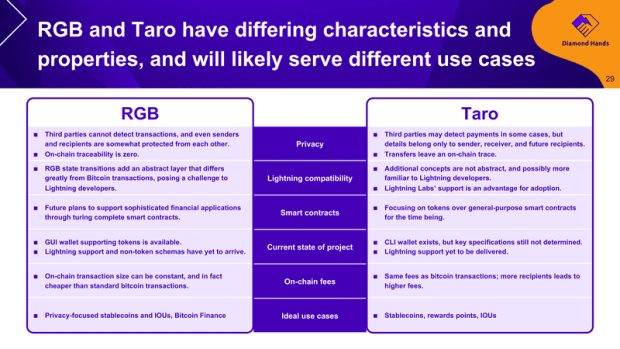

Protocol growth just isn’t straightforward, and infrequently takes years. Deciding what options to prioritize and compromise on is vital, and one of many major differentiators between RGB and Taro is the selections they’ve made in that regard.

RGB, with its ambitions as a smart-contracting layer on high of Bitcoin (i.e., not only for tokens), has a strong on-chain protocol to execute off-chain state transitions. Cautious design has resulted in superior privateness, on-chain scalability and flexibility, at the price of conceptual complexity. However, Taro appears to be extra targeted on off-chain use, similar to on the Lightning Community, specifying strategies for multi-hop funds and token alternate. Nonetheless, among the many sensible shortcuts Taro has taken in favor of conceptual simplicity is its neglect to standardize not less than one primary constructing block of its on-chain protocol.

Since Taro property are saved utilizing an on-chain UTXO, Taro transactions can theoretically be constructed in two methods: one the place the sender pays bitcoin for the recipient’s output, and the opposite the place the recipient contributes their very own enter to pay for it themselves. The previous case is less complicated, however the sender is successfully gifting some bitcoin; the latter might be extra exact, however requires sender-recipient interplay to create the transaction. Except these strategies and their choice are standardized, pockets interoperability is a pipe dream.

Maybe Taro’s reluctance to standardize such a primary element might be defined by its method to growth. Total, whereas RGB is being developed fairly transparently, Lightning Labs appears to order extra management over its mission in Taro, presumably to take a extra iterative, feedback-based method to bringing its product to market.

Certainly, as soon as a protocol is extensively adopted it’s troublesome to replace or change with out breaking interoperability. Nonetheless, this isn’t essentially the case in case your implementation is the one one. Lightning Labs could also be reserving its means to quickly iterate by deliberately suspending widespread adoption of the protocol. I obtained this impression from the aforementioned hole in standardization, in addition to the truth that Lightning Labs plans to ship its Taro pockets with LND, its Lightning node implementation with greater than 90% market share.

It’s actually potential that Lightning Labs’ method shall be extra profitable at bringing tokens to Lightning. However until it surrenders its dominant function in some unspecified time in the future, Taro dangers turning into little greater than an LND API. It’s not unimaginable to me that Taro will stay an LND-specific function.

Will Lightning Survive Tokens?

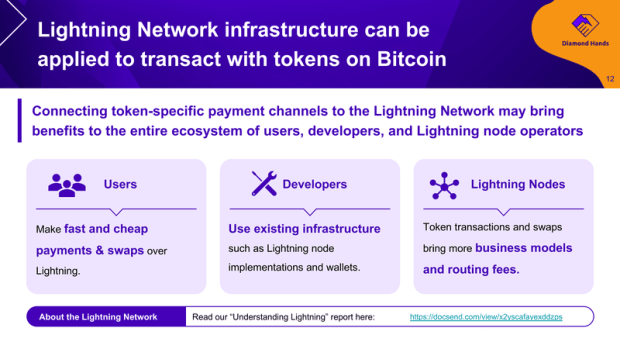

As a semi-paranoid Bitcoiner, I have to surprise if the proliferation of tokens on Bitcoin will lead to detrimental penalties for the Lightning Community or Bitcoin itself. Whereas issues of the latter are validated by Circle’s (the issuer of USDC) means to affect customers throughout any potential contentious exhausting fork in Ethereum, I wish to level out a particular avenue of concern for Lightning.

As talked about earlier, Taro’s method if continued will outcome within the elevated utility of LND via use of its included Taro pockets, in relation to different implementations. This could doubtlessly additional lock in LND’s dominant place within the node implementation panorama. To maintain Lightning decentralized, it’s preferable that customers are unfold extra evenly throughout a number of implementations, in order that even the most well-liked implementation can not merely implement protocol adjustments with out consequence to its customers.

Whereas I personally am not a fan of the overwhelming majority of crypto tokens, I do imagine that the Lightning Community has one thing to prospectively provide customers of such tokens: quick, personal and decentralized alternate and funds. Having the ability to pay somebody of their native or most popular foreign money immediately, with out the sender proudly owning any of it, has immense potential to disrupt current fee and remittance rails. Although it’s unclear what protocol will prevail for token issuance on Bitcoin, I hope that proliferation of tokens is not going to sacrifice the issues that bitcoin and Lightning stand for.

This can be a visitor submit by Kishin Kato. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.