Wasabi Pockets’s WabiSabi protocol is designed to eradicate change outputs from CoinJoins, higher defending Bitcoin customers’ privateness.

That is an opinion editorial by Thibaud Maréchal, a contributor to privacy-focused Bitcoin pockets venture Wasabi Pockets.

A lot ink has been spilled on the privateness horrors of change outputs for Bitcoin. It’s now broadly understood that Bitcoin is a pseudonymous community, the place all customers are recognized by the addresses they use. When making a bitcoin transaction, as an alternative of solely sending the precise quantity that’s wanted — like in conventional, account-based fee methods — you ship all of the sats from the unique deal with into new ones. This creates a change output, which is the quantity you get again when making a fee.

Such a change output is sort of dangerous for privateness, as most customers underestimate, or generally fully ignore, how simple it makes it for somebody to trace all associated funds.

Let’s look at why the change output is also known as “poisonous” and dangerous for privateness.

Privateness Issues For Change Outputs

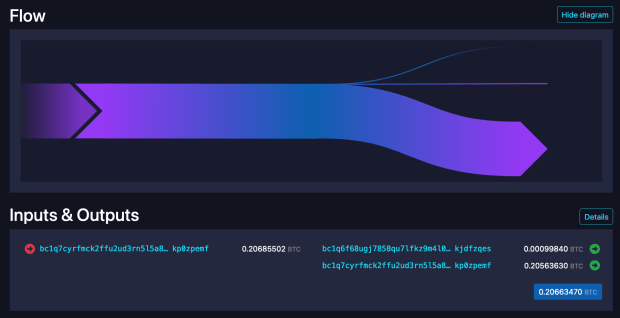

Within the above image, we are able to see that all the things from the deal with on the left obtained moved into two addresses on the best, whereas a 3rd, small half was spent as a Bitcoin community transaction charge.

Outsiders do not essentially know at this level which output was the fee and which one went again to the sender as change. Solely the sender and the receiver know definitely which one is which. Nonetheless, the receiver can now observe the change output, and see the place the fee comes from. As identified by many Bitcoin privateness researchers, a change output is a privateness nightmare that may undo a few years of diligent UTXO administration.

CoinJoins To The Rescue?

There’s a sort of collaborative bitcoin transaction that allows you to group up your UTXOs with different individuals’s cash to achieve privateness, with out ever shedding custody of them, referred to as a CoinJoin. Typically, a whole lot of individuals be a part of their cash collectively, making it exhausting to trace the flows of funds, together with change outputs in some instances.

CoinJoin consists of a number of inputs and outputs from many various customers, making it exhausting for outsiders to know who owns what after the CoinJoin is finished. The generally used methodology is to create a number of outputs of equal denominations which can be indistinguishable from one another. This creates a excessive stage of obscurity for all individuals. CoinJoins normally have minimum-amount necessities that customers should meet with the intention to take part and most implementations nonetheless produce a change output. In idea, the quantity could possibly be something however due to the specter of denial-of-service (DoS) assaults, most CoinJoin coordinators require a slightly excessive quantity to make it troublesome for a nasty actor to disrupt the CoinJoin spherical.

Whenever you make a fee with personal UTXOs from a CoinJoin, the intent is that the receiver of your funds will not be capable to know your cash’ previous transaction historical past. That could be a nice enchancment to the unique scenario, the place all your earlier transactions could possibly be tracked, however there’s nonetheless one drawback to resolve: The recipient can nonetheless comply with your change output. Because of this, it is strongly recommended to CoinJoin earlier than and after a fee is made.

How do totally different CoinJoin implementations comparable to Wasabi, Samourai and JoinMarket handle change outputs? Are CoinJoins the definitive resolution to do away with the change output drawback? Is there a greater approach to take care of poisonous change inside CoinJoins?

There are numerous issues when taking a look at change-output administration in CoinJoins. Let’s discover the three major ways in which exists presently:

Inclusion of change in a CoinJoin (as in Wasabi Pockets 1.0 and JoinMarket)Isolation of change earlier than a CoinJoin (Samourai Pockets with Whirlpool)Elimination of change in a CoinJoin (Wasabi Pockets 2.0)

Inclusion Of Change In A CoinJoin

Wasabi 1.0 CoinJoin. Supply.

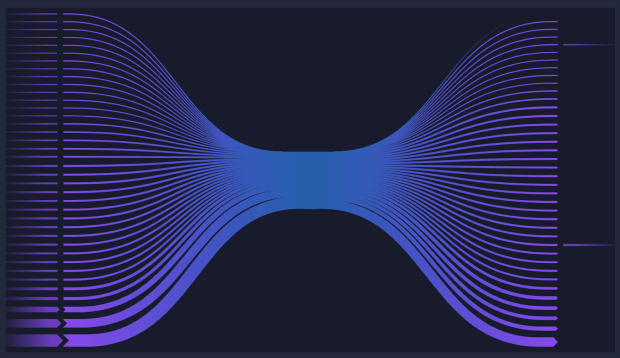

On this possibility, change outputs are included in a CoinJoin. This technique could be known as “change output inclusion” and it’s utilized in Wasabi Pockets 1.0 and JoinMarket.

Wasabi 1.0 requires round 0.1 BTC to take part in CoinJoins, whereas in JoinMarket, many various denominations can be found. The excessive 0.1 BTC requirement of Wasabi 1.0 makes it inconceivable for many individuals to make use of. JoinMarket makes it a bit extra reachable with customized denominations, although the troublesome person expertise is a barrier for many. In JoinMarket, it’s a must to discover or turn into a maker who supplies liquidity. Makers determine the values for a CoinJoin, however it would nonetheless create some change outputs as takers have totally different quantities.

In each instances, change outputs are current within the CoinJoin transaction, making it generally potential for an out of doors observer to hyperlink the change output to the enter, particularly if a person just isn’t cautious to keep away from consolidations sooner or later. In a CoinJoin, change outputs get believable deniability if there are sufficient customers in a spherical to supply cowl. A number of inputs and a number of outputs in a transaction would make it harder to determine which enter a change output corresponds to. The bigger the transaction, the harder and dear is the evaluation to hyperlink a given output to an enter. The person can register a number of totally different inputs of small quantities, so long as they add as much as at the very least the minimal for a given CoinJoin spherical. That being mentioned, as a result of just one transaction is required, it’s fairly easy and low-cost for a person to take part in CoinJoins.

In Wasabi 1.0, if a person has, for instance, one UTXO price 0.17 BTC, they’ll take part in a CoinJoin spherical to get a roughly 0.1 BTC personal coin, however in addition they get a roughly 0.07 BTC change output. That is the case as a result of it can’t be assumed that there are going to be a number of 0.17 BTC inputs or 0.07 BTC outputs to supply cowl (an satisfactory anonymity set), despite the fact that this may occur by coincidence. Within the Wasabi 1.0 interface, CoinJoin UTXOs are labeled as personal with a inexperienced protect, whereas the non-private change outputs are labeled with a clearly-visible crimson protect. If a person tries to consolidate by spending them collectively, they are going to see a warning discouraging the consolidation, although it may possibly nonetheless be executed.

In some instances, it’s thus nonetheless potential to hyperlink a change output in Wasabi 1.0 and in JoinMarket to different inputs and outputs, which makes the change inclusion technique in these CoinJoins not that strong over time.

Let’s take into account different options.

Isolation Of Change Earlier than A CoinJoin

Whirlpool CoinJoin. Supply.

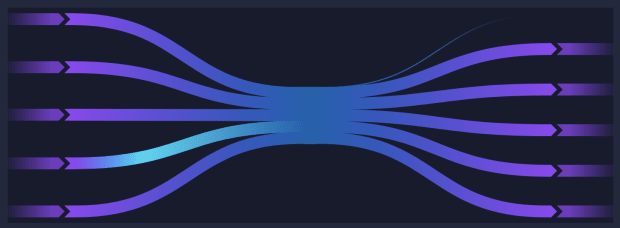

On this possibility, change outputs are excluded and remoted earlier than a CoinJoin occurs. This technique could be known as “change output isolation” and it is the one which Samourai Pockets makes use of for its Whirlpool implementation.

Whirlpool depends on 4 CoinJoin pool sizes of various denominations, particularly 0.5 BTC, 0.05 BTC, 0.01 BTC and 0.001 BTC, nevertheless it comes with the inherent tradeoff of splitting the liquidity, which may result in delays and decrease privateness.

In Samourai, if a person additionally has one coin price 0.17 BTC, they first should take part in a preparation transaction referred to as “Tx0.” Tx0 is a proposed approach to do away with change earlier than a Whirlpool CoinJoin.

Let’s assume the person now chooses the 0.05 BTC pool to CoinJoin in. Earlier than the person will get into the CoinJoin, they break the 0.17 BTC enter into three commonplace, roughly 0.05 BTC outputs and a roughly 0.02 BTC change output and pay the coordinator charge. These three outputs of about 0.05 BTC every are then anticipated to CoinJoin within the 0.05 BTC pool in some unspecified time in the future, whereas the remaining roughly 0.02 BTC is shipped to a special, automatically-generated sub-wallet that they personal, also known as the “dangerous financial institution” holding “doxxic change.” Although it’s technically correct that Whirlpool CoinJoins should not have a poisonous change output, they’re nonetheless creating one that may be adopted; it is simply within the Tx0 earlier than it. Tx0 isolating the poisonous change output in a person sub-wallet earlier than a CoinJoin is worse for privateness than having it included within the CoinJoin, as there isn’t a one to supply cowl for the change output.

In Whirlpool, if the person wished to consolidate and spend change with CoinJoin outputs collectively, it might be very troublesome as they belong to totally different sub-wallets. This may occasionally initially sound good nevertheless it comes with an inherent downsides concerning value and person expertise. A person should still wish to use the remoted poisonous change output because it represents an vital amount of cash. They might put the change within the smaller pool and pay one other coordinator charge for it however there would nonetheless be significant leftovers. There are additionally official edge instances through which a person could possibly be keen to consolidate a UTXO from a CoinJoin with a change output, like when a brand new Samourai Pockets person realizes that the pockets sends his XPUB to Samourai servers by default.

Change output isolation additionally creates a burden on the person as they now should take care of one other non-standard sub-wallet. This sub-wallet additionally makes recoverability of funds harder with different wallets, which creates some type of vendor lock-in with Samourai, regardless of it being a non-custodial pockets.

Making a separate sub-wallet to isolate change outputs from CoinJoin transactions is, at finest, an experiment that has confirmed fairly blockspace inefficient, and due to this fact costly for customers. Whereas many Samourai supporters reward it, Tx0 appears to me to be a naive try at dealing with the issue of change-output administration in CoinJoins.

Inclusion methods comparable to these with Wasabi 1.0 and JoinMarket, the place change outputs are included in CoinJoins, are higher at defending person privateness when it comes to usability, blockspace effectivity and costs. Though each inclusion and isolation will also be fairly dangerous for person privateness if poorly dealt with because of consolidation threat.

If a person consolidates totally different Tx0 poisonous change outputs collectively to enter one other CoinJoin pool, it might be clear that the entire totally different change outputs and Tx0s had been made by the identical individual, which is a privateness leak. As we are able to see on the KYCP and OXT web sites, that are closed-source chain evaluation instruments constructed by Samourai, Whirlpool CoinJoins look “prettier” than JoinMarket and Wasabi CoinJoins, because the change output just isn’t included within the transaction. As beforehand mentioned, in Wasabi 1.0 and JoinMarket CoinJoins, the change output is within the CoinJoin, making it blockspace environment friendly however “ugly,” since not all outputs are equal. Within the change inclusion technique, if there are a number of customers, even the change output won’t be clearly related to its authentic enter. In Tx0, it’s all the time 100% clear.

Whirlpool customers have to decide on which pool they wish to take part in, and have to participate in at the very least two transactions, which is a Tx0 to isolate the change, adopted by an equal output CoinJoin transaction. The design of Whirlpool limits the variety of inputs and outputs to 5, respectively, so a person trying to obtain privateness should CoinJoin fairly a couple of instances because of their small dimension, including additional delays.

What can be a greater approach to handle change outputs in CoinJoins, if not isolation or inclusion?

Elimination Of Poisonous Change In A CoinJoin

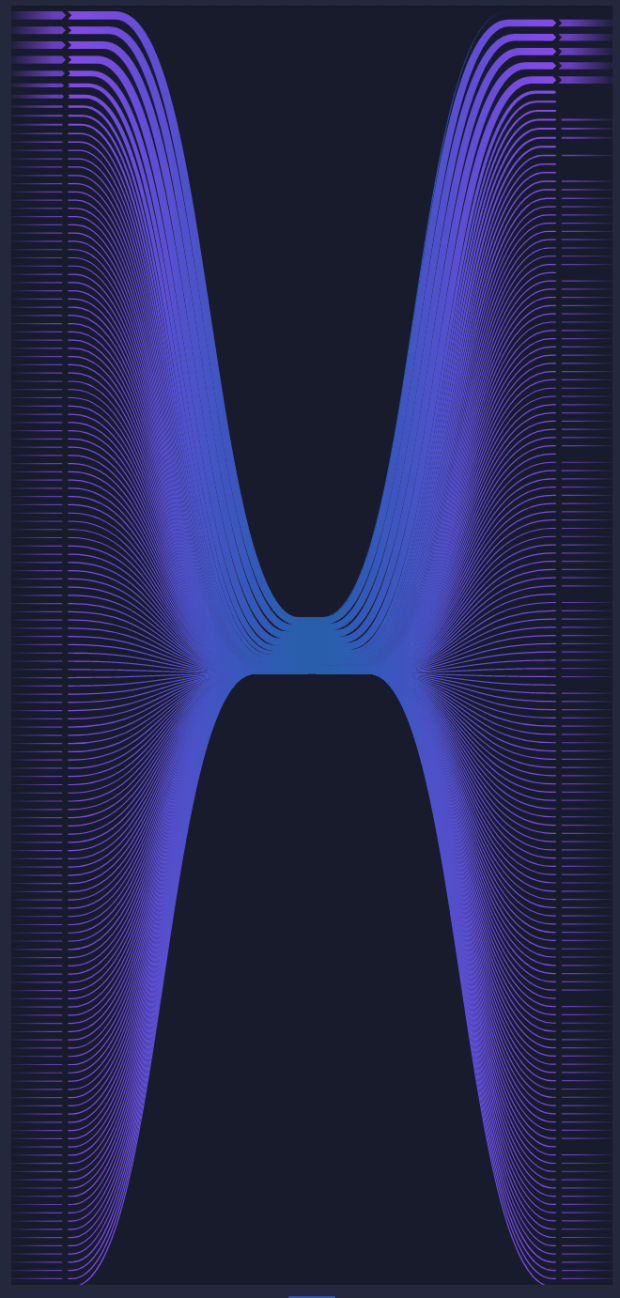

Wasabi 2.0 CoinJoin (Mempool.Area is presently restricted to exhibiting a most of 150 inputs and outputs every, whereas Wasabi Pockets 2.0 CoinJoins can embody as much as 400 every). Supply.

On this final possibility, poisonous change outputs are outright eradicated throughout a CoinJoin. Since we can’t correctly handle change outputs, we should do away with them. No extra change outputs. Reviewing the evolution of CoinJoins, having one commonplace denomination per pool appears fairly static, and invitations consolidation and poisonous change, which is dangerous for privateness. With single-denomination CoinJoins comparable to with Wasabi 1.0, JoinMarket and Samourai (Whirlpool), the issue of change outputs can’t be eradicated.

The ZeroLink protocol that Nopara73, the founding father of Wasabi Pockets, designed and developed together with others, was not optimized for multiple-denomination CoinJoins, so a redesign was required. Enter the WabiSabi protocol with arbitrary-amount CoinJoins, permitting a number of denominations, which efficiently eliminates the problematic change outputs in single denomination CoinJoins.

After nearly three years of analysis, the Wasabi group invented a novel approach of doing CoinJoins through the use of key-verified nameless credentials (KVACs) and a particular sort of quantity group, maximizing privateness and effectivity whereas eliminating change outputs. The brand new cryptographic protocol was named WabiSabi, which is a Japanese phrase for locating magnificence in imperfection, and the re-design of the Wasabi Pockets that makes use of WabiSabi was named Wasabi 2.0.

With WabiSabi, as an alternative of getting to consolidate inputs to satisfy a minimal denomination, every enter (with a most of 10, as specified by the Wasabi 2.0 consumer) will get registered individually, leading to no connection between totally different inputs registered in a CoinJoin spherical. The minimal denomination within the WabiSabi protocol that Wasabi 2.0 makes use of is simply 0.00005000 BTC (5,000 sats), which signifies that now, everybody is ready to reclaim their privateness and take part in CoinJoins.

The person can register as much as 10 inputs and stand up to proper outputs, with randomization. Inputs could also be damaged down into a number of smaller outputs or consolidated into fewer massive outputs, or each. A big record of predetermined output quantities permits having a number of equal quantity outputs of various denominations, with out making a change output. Even when there’s an unequal quantity output whose worth is simply near the opposite outputs, it’s virtually inconceivable to know which enter or output it’s linked to because of having so many prospects.

A person could determine to CoinJoin a number of instances (referred to as a remix) to get higher believable deniability, however one transaction can already present sufficiently good privateness. Usually, regardless of how a lot bitcoin a Wasabi 2.0 person has, they are able to CoinJoin all of their UTXOs in a single single transaction, typically with out making a poisonous change output. With Wasabi 2.0 CoinJoins, there are not any deterministic hyperlinks between enter and outputs, excluding whales who’ve a lot bigger inputs than all the opposite individuals’, which due to this fact require extra rounds of CoinJoins to reclaim their privateness completely.

In Wasabi 2.0, you’ll be able to manually alter your UTXO choice to keep away from making a change output in your fee. In its change-avoidance function, Wasabi 2.0 recommends choices to barely modify your fee quantity with the intention to keep away from creating undesirable change. Even in case you do find yourself making a change output from sending beforehand CoinJoined bitcoin, it may be routinely registered in one other CoinJoin free of charge.

A brand new period of digital privateness has begun with CoinJoins for bitcoin, and the WabiSabi CoinJoin protocol used within the Wasabi Pockets 2.0 appears to have mounted a serious design tradeoff of the Bitcoin UTXO mannequin. Change outputs can now be eradicated from CoinJoin transactions, which has enormous implications for bitcoin wallets when it comes to privateness and value. Bitcoiners utilizing CoinJoins need not fear about change outputs being a privateness threat or outright legal responsibility anymore.

“Change output?” you ask. What change output? There isn’t any change output.

It is a visitor submit by Thibaud Maréchal. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.