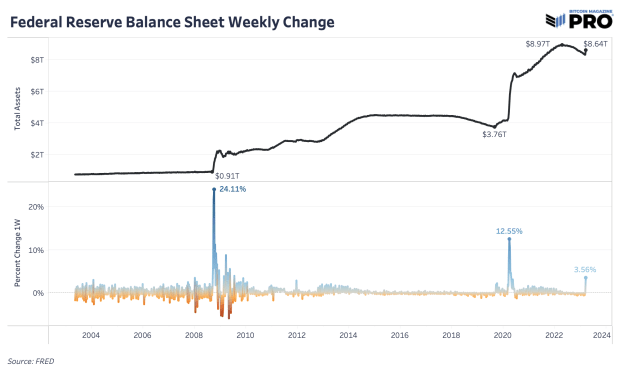

The Federal Reserve stability sheet elevated by $300 billion in a single week, resulting in debate about whether or not these actions qualify as quantitative easing.

The article under is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The Lender Of Final Resort

Simply days after the fallout from Silicon Valley Financial institution and the institution of the Financial institution Time period Funding Program (BTFP), there’s been a major rise within the Federal Reserve’s stability sheet after a full 12 months of decline by way of quantitative tightening (QT). The PTSD from in depth quantitative easing (QE) is inflicting many individuals to sound the alarms, however the modifications within the Fed’s stability sheet are much more nuanced than a brand new regime shift in financial coverage. In absolute phrases, it’s the most important improve within the stability sheet we’ve seen since March 2020 and in relative phrases, it’s an outlier that’s catching everybody’s consideration.

The important thing takeaway is that that is a lot completely different than the QE spree of asset shopping for and the stimulative simple cash with near-zero rates of interest that we’ve skilled over the past decade. That is about choose banks needing liquidity in occasions of financial misery and people banks getting short-term loans with the purpose of overlaying deposits and paying the loans again in fast trend. It’s not the outright buy of securities to indefinitely maintain on the stability sheet from the Fed, however slightly stability sheet property that must be short-lived whereas persevering with QT coverage.

Nonetheless, it’s a stability sheet growth and a liquidity improve within the short-term — doubtlessly only a “non permanent” measure (nonetheless to be decided). On the very least, these liquidity injections assist establishments not turn into pressured sellers of securities after they in any other case can be. Whether or not that’s QE, pseudo QE, or not QE is in addition to the purpose. The system is exhibiting fragility as soon as once more and the federal government has to step in to maintain it from going through a systemic danger. Within the short-term, property that thrive on liquidity improve, like bitcoin and the Nasdaq which have ripped larger at the very same time.

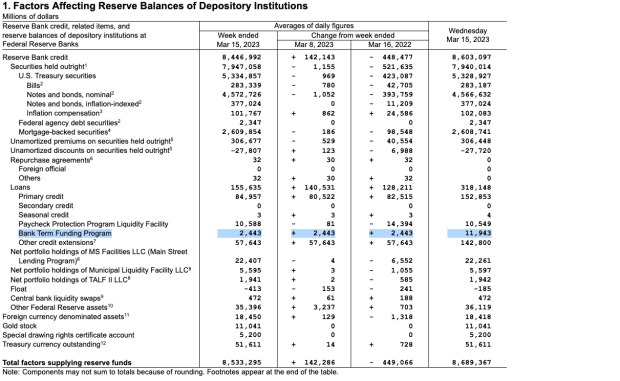

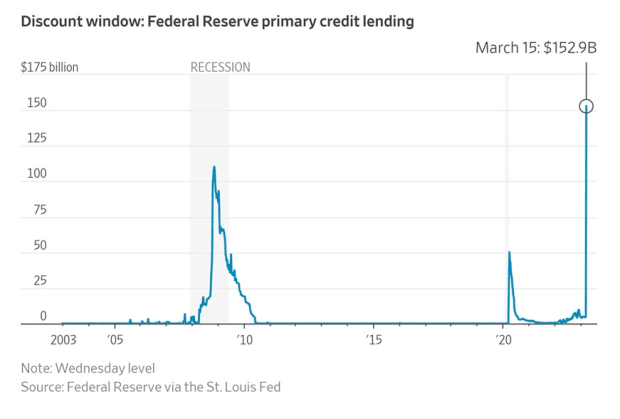

This particular improve of the Fed’s stability sheet is because of an increase in short-term loans throughout the Fed’s low cost window, loans to FDIC bridge banks for Silicon Valley Financial institution and Signature Financial institution and the Financial institution Time period Funding Program. Low cost window loans had been $152.8 billion, FDIC bridge financial institution loans had been $142.8 billion and BTFP loans had been $11.9 billion for a complete of over $300 billion.

The extra alarming improve is within the low cost window lending as that may be a final resort, excessive value liquidity choice for banks to cowl deposits. It was the most important low cost window borrowing on document. Banks utilizing the window are saved nameless as there’s a reliable stigma subject from discovering out who’s in want of short-term liquidity.

This brings again current recollections of the 2019 emergency liquidity injection and intervention by the Fed into the repo market to stabilize money demand and short-term lending actions. The repo market is a key in a single day financing technique between banks and different establishments.

Obtain the FREE “Banking Disaster Survival Information” In the present day!

Get your copy of the total report right here.

The Upcoming FOMC Assembly

The market continues to be anticipating a 25 bps fee hike on the FOMC assembly subsequent week. All-in-all, the market turmoil up to now hasn’t confirmed to “break sufficient issues” but, which might require an emergency pivot from central bankers.

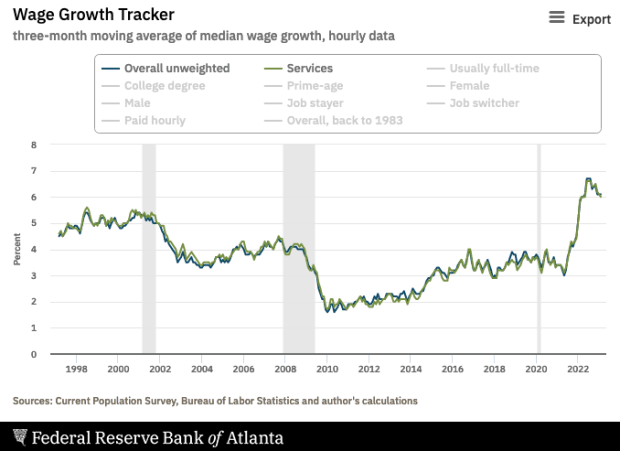

On its path to bringing inflation again to the two% goal, month-over-month Core CPI was nonetheless rising in February whereas preliminary jobless claims and unemployment haven’t budged a lot. Wage progress, particularly within the providers sector, nonetheless stays pretty robust on the 3-month annualized fee of 6% progress final month. Though barely coming down, extra unemployment is the place we must see extra weak point within the labor market so as to take wage progress a lot decrease.

We’re doubtless removed from the top of the chaos and volatility this 12 months,as every month has introduced new ranges of uncertainty out there. This was the primary signal of the system needing Federal Reserve intervention and swift motion. It doubtless gained’t be the final in 2023.

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles straight in your inbox.

Related Previous Articles:

Banking Disaster Survival GuidePRO Market Keys Of The Week: Market Says Tightening Is OverLargest Financial institution Failure Since 2008 Sparks Market-Extensive FearBanking Troubles Brewing In Crypto-LandA Story of Tail Dangers: The Fiat Prisoner’s DilemmaThe Financial institution Of Japan Blinks And Markets TrembleThe The whole lot Bubble: Markets At A CrossroadsSilvergate Financial institution Faces Run On Deposits As Inventory Value TumblesCounterparty Threat Occurs FastNot Your Common Recession: Unwinding The Largest Monetary Bubble In Historical past

Source link